At the beginning of this year I started to compute how many dividends I am going to collect from my stock holdings in this year. At the time of computation I realized that this might not be a straight forward endeavor. Namely because it is not immediately clear for the layman how much tax is deducted for withholding tax purposes respectively how much money can be reclaimed from the Swiss tax authorities for withheld taxes on foreign stock holdings. What made things even more intricate is the fact that I keep my stocks at a Swiss broker Cornertrader as well as at a foreign one namely Interactive brokers (IA). I would like to go through my case to the best of my knowledge in order for people to better understand how the system works for a Swiss resident i.e. for somebody that pays his/her taxes to the Swiss government. I focus my case solely on stocks as well as on ETFs that are listed in the US. Please note this is only an example and should it no way constitute a tax advisory in any way. Please consult with your lawyer to discuss your specific case.

When did I reclaim the withhold money?

When I declared my taxes for the year 2020 I also filed so-called DA-1 form. It’s basically a form to request for tax on foreign dividends and interest refund request of USA tax withheld.

How does the Swiss authorities handle DA-1 forms

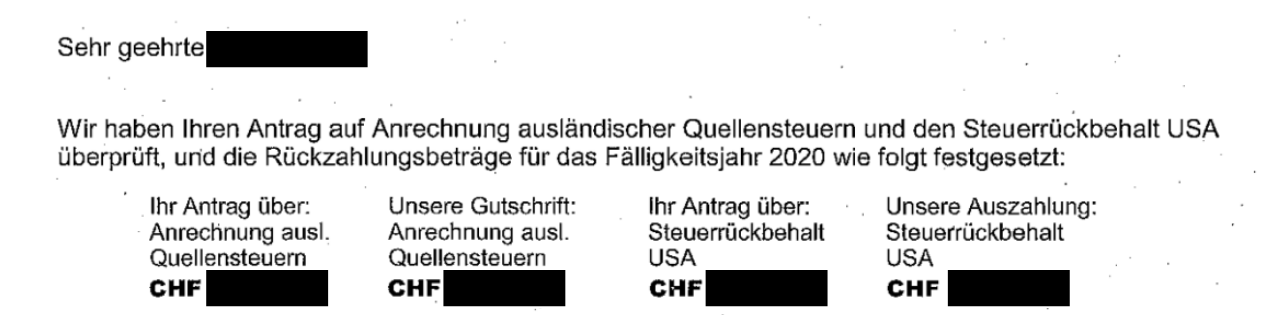

After I have handed in all the forms including DA-1 they check on the requested amount and make a decision based on several factors. We are going to look into those factors in more detail. Below you can see the letter I got from the Swiss authorities that basically says how much of the re-claimed money they are going to pay me. Please note the exact practice may vary from Canton (district) to Canton i.e. it does not necessarily mean that all Cantons are paying it out directly but some might also deduct it from the amount of tax that you are going to pay.

How big is the withholding tax?

The answer is: It depends.

First of all it depends on where the issues are listed because every country can decide for itself how much it withholds. E.g. Switzerland withholds 35% of the paid dividend for stocks listed in Switzerland. Generally, for US listed stocks it is at least 15%. Then it also depends on the kind of holdings. E.g. if you hold limited partnerships it might be much higher than plain-vanilla stocks. What is interesting is that if I as a Swiss resident hold US stocks via a Swiss intermediary (bank) e.g. Cornertrader or ZKB, this intermediary must withhold an additional 15%. I found the following excerpt in a leaflet of the Swiss Federal Tax Administration. (German only)

Wer in der Schweiz als „Qualified Intermediary“ für fremde Rechnung von amerikanischen Gesellschaften oder deren Zahlstellen amerikanische Dividenden zu 85 oder 95 Prozent ihres Bruttobetrages entgegennimmt, muss von dem zwecks unmittelbarer Zahlung oder Gutschrift an nutzungsberechtigte Empfängerinnen oder Empfänger, die in der Schweiz ansässig sind, oder

zwecks Vergütung in deren Auftrag an eine im Ausland ansässige Person empfangenen Betrag

15 Prozent (bei Entgegennahme von 85 Prozent des Bruttobetrages) oder 25 Prozent (bei Entgegennahme von 95 Prozent des Bruttobetrages) der Bruttodividende zurückbehalten (Art. 11 Abs.

1 VO DBAUS 96).

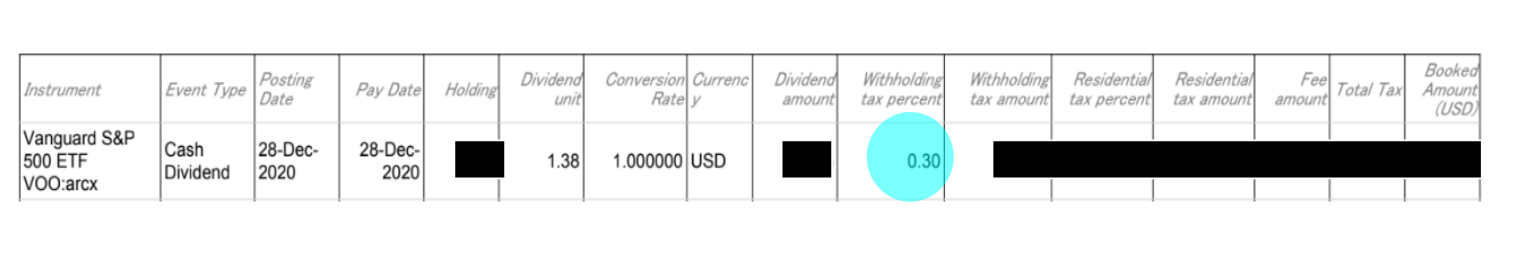

Eventually this means that an eye-watering 30% of the total amount of dividend of my US stock holdings in my deposits at Cornertrader are withhold. This also explains the 30% of withhold tax percent when checking out the shares dividend report of my Cornertrader account as shown below:

Can I reclaim the complete withhold tax?

Again the answer is it depends. Generally, we need to distinguish between the additional 15% for US stocks that are withhold by the “Qualified Intermediary” and the “ordinary” withhold tax. My understanding is that in general the full amount for the additional 15% for US stocks can be reclaimed. Unfortunately, in my case and to be honest I am not entirely clear on why Cornertrader appeared not to qualify as “Qualified Intermediary” for the year 2020. Thus, the Swiss Tax Authorities informed that they are not paying me any of the claimed additional withhold tax. I called Cornertrader to ask on why this is the case considering that they actually deducted exactly those 15%. The answer was somewhat vague in that they told me that actually there is actually a third-party intermediary who makes that deduction before them. It appears as that is why the Swiss tax authorities rejected my bid. Obviously, this is not ideal and I hope this situation will change in the future.

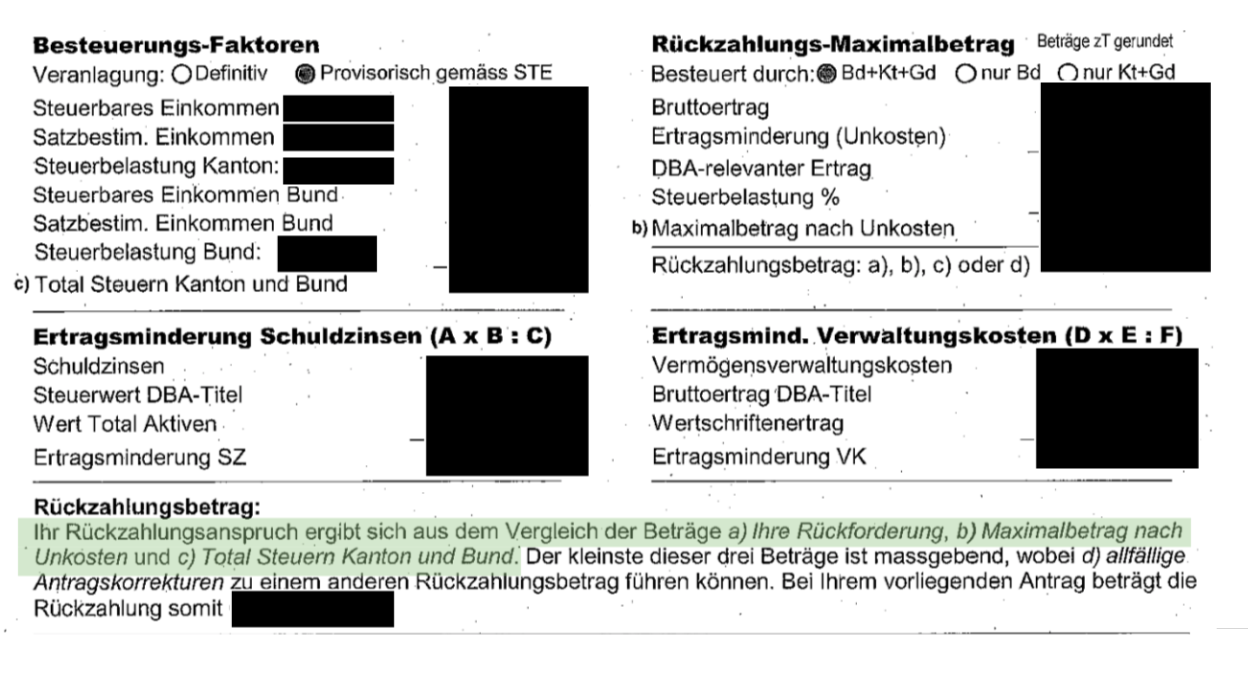

For the ordinary withhold tax the situation is somewhat more complex. Looking at the answer from the tax office, I found the following sentence (green marked below).

“Ihre Rückzahlungsanspruch ergibts sich aus dem Vergleich der Beträge a) Ihre Rückforderung, b) Maximalbetrag nach Unkosten und c) Total Steuern Kanton und Bund.

So this eventually means the maximally claimed amount of withholding tax is capped according to two values:

- Maximal reclaimable amount after expenses

- Total amount of taxes to the Canton and the Swiss Confederation

Maximal reclaimable amount after expenses

The maximal claimable amount after expenses does the following. Firstly, it subtracts the expenses that correspond to the asset management for the securities that produces the income for which you want to reclaim the withholding tax. To understand that better I make the following example:

Assuming I had shares of the Vanguard S&P 500 ETF of let’s say 100’000 CHF. In my Canton to the best of my knowledge I could deduct 0.3% for expenses of the asset management for this fund i.e. 300 CHF for this year in the tax declaration. Assuming further that this fund would have paid 1500 CHF in gross dividend in the year 2020 to me, the relevant gross income for the computation of the maximal reclaimable withholding tax amount would be 1500 CHF minus the 300 CHF for the expenses i.e. 1200 CHF. It appears to me that they do this because I could deduct the 300 CHF expenses already from my total income in the tax declaration. Hence, they only allow the consider the reduced amount for the reclaimable maximal amount. The witholding tax would be 15% of the gross payment i.e. 225 CHF.

To get the maximal reclaimable amount after expenses they then consider the relative amount of payable taxes to the Canton and the Swiss Confederation. Assuming in the above example that I would be subject to 11% income tax to the Canton and and 1% to the Swiss Confederation the maximal reclaimable amount would be 1200 CHF * 12% = 225 CHF. This would mean that I would only be able to reclaim a maximal amount of 225 CHF and not the full 250 CHF.

Naturally, the question arises at what income level would I reach a relative tax rate of 15% such that in theory I could reclaim the full amount. In the upper chart below below you can find the tax for the canton of Zurich, the municipality tax, the federal tax and the total tax for the year 2020. Please note, for the total tax I assumed here that the taxable income is the same canton and federation which may or may not be true. In the lower chart you see the tax rates i.e. the tax to be paid divided by the taxable income. In the dropdown menu on the top you can select the different municipality in the canton of Zurich. Obviously the point at which one reaches 15% relative tax rate varies depending on the selected municipality. While in the City of Zurich it is around 85’500 CHF, it is e.g. in the municipality Erlenbach around 109’000 CHF. Please note, I cannot guarantee the correctness of the data. You can find the source code for the HTML as well as a Python GUI on Github. So in the above example to be able to reclaim the full 250 CHF, one would need a relative total tax rate of higher or equal than 20.83% (250 / 1200) one would need to have a taxable income of greater than 141’700 CHF if I am not mistaken which is quite significant.